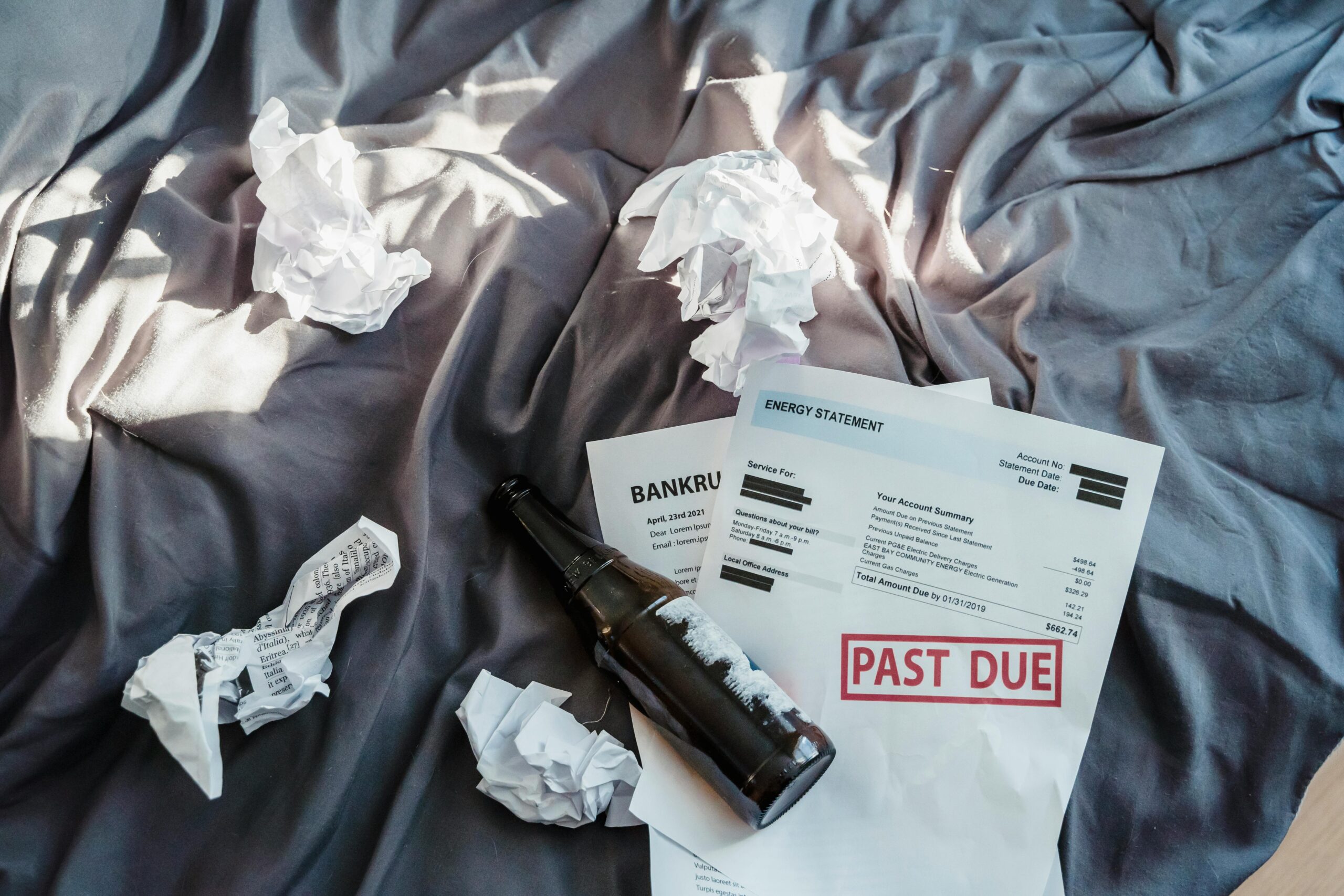

Money troubles don’t just empty wallets—they drain emotional reserves, damage relationships, and create a silent crisis affecting millions worldwide. 💔

The weight of unpaid bills, mounting debt, and constant financial pressure creates a psychological burden that many people carry alone. While society often focuses on the practical aspects of money management, the emotional devastation caused by late payments and chronic money stress remains largely invisible. This silence perpetuates shame, isolation, and mental health struggles that deserve recognition and compassionate understanding.

Financial stress has become one of the most pervasive sources of anxiety in modern life, yet it remains shrouded in stigma and secrecy. People struggling with late payments often suffer in silence, afraid of judgment, embarrassment, or appearing irresponsible. This article explores the profound emotional toll of financial difficulties, examining how money stress affects mental health, relationships, physical wellbeing, and overall quality of life.

The Hidden Mental Health Crisis Behind Financial Struggles 🧠

Financial stress operates as a constant background noise in the minds of those experiencing it. Unlike temporary stressors that come and go, money worries often persist relentlessly, creating a chronic state of anxiety that fundamentally alters brain chemistry and emotional regulation.

Research consistently demonstrates strong correlations between financial difficulties and mental health disorders. People experiencing persistent money problems show significantly higher rates of depression, anxiety disorders, and even suicidal ideation compared to financially secure populations. The relationship works bidirectionally—financial stress contributes to mental health problems, while mental health challenges can impair financial decision-making and stability.

Late payments specifically create a unique psychological pressure. The anticipation of missed deadlines, threatening letters, phone calls from creditors, and potential consequences generates a state of hypervigilance. This constant alertness exhausts mental resources, leaving individuals emotionally depleted and cognitively impaired. Many describe feeling paralyzed, unable to address problems even when solutions exist.

The Shame Spiral: Why Financial Struggles Feel So Personal

Cultural narratives around financial success create an environment where money problems feel like personal failures rather than systemic issues or unfortunate circumstances. Society often portrays wealth as a direct result of hard work and intelligence, implicitly suggesting that financial struggles indicate laziness or incompetence.

This shame prevents people from seeking help, discussing their situations openly, or accessing resources that might alleviate their difficulties. The isolation intensifies emotional distress, creating a vicious cycle where shame leads to secrecy, secrecy prevents problem-solving, and worsening problems generate more shame.

Many individuals report feeling fundamentally inadequate when facing late payments or debt. These feelings extend beyond the specific financial situation, contaminating self-perception across all life domains. People begin questioning their worth, competence, and deservingness of happiness or security.

How Money Stress Infiltrates Every Aspect of Life 🏠

Financial difficulties rarely remain confined to the realm of bank statements and bills. The stress radiates outward, affecting relationships, career performance, physical health, and even parenting capabilities. Understanding these ripple effects illuminates why financial stress represents such a comprehensive threat to wellbeing.

Relationships Under Financial Pressure

Money represents one of the leading causes of relationship conflict and divorce. Late payments and financial stress intensify these tensions exponentially. Couples experiencing money problems report increased arguments, decreased intimacy, and growing resentment toward partners.

Financial stress creates several relationship challenges simultaneously:

- Communication breakdown as partners avoid discussing painful financial realities

- Blame and defensiveness replacing collaborative problem-solving

- Loss of shared activities as money constraints eliminate entertainment and connection opportunities

- Power imbalances when one partner earns more or manages finances unilaterally

- Future planning difficulties when financial instability makes commitments feel impossible

Beyond romantic relationships, financial stress strains friendships and family connections. People often withdraw from social activities they can’t afford, gradually becoming isolated. The inability to reciprocate generosity, participate in celebrations, or maintain expected standards creates embarrassment that erodes social bonds.

The Physical Body Keeping Score

Chronic stress doesn’t just affect emotions—it manifests in tangible physical symptoms. The body’s stress response system, designed for short-term threats, becomes dysfunctional under persistent financial pressure. This chronic activation produces measurable health consequences.

Common physical manifestations of money stress include:

- Sleep disturbances and insomnia as worries prevent restful sleep

- Digestive problems including stomach pain, nausea, and irritable bowel syndrome

- Headaches and muscle tension, particularly in neck and shoulders

- Weakened immune function leading to frequent illness

- Cardiovascular problems including elevated blood pressure and heart disease risk

- Chronic fatigue despite adequate rest

These physical symptoms create additional problems. Medical care becomes more necessary precisely when financial resources make it less accessible. Health issues may impair work performance, potentially threatening income stability. The interconnection between financial and physical health creates another reinforcing cycle of deterioration.

The Cognitive Burden: How Financial Worry Hijacks Mental Resources 🔄

One of the most insidious effects of money stress involves its impact on cognitive function. Financial worry literally consumes mental bandwidth, reducing capacity for other tasks requiring attention, memory, or executive function.

Psychological research reveals that poverty and financial stress effectively reduce cognitive capacity equivalent to a significant IQ point decrease. This isn’t about intelligence—it’s about available mental resources. When the brain constantly processes financial threats and problems, fewer resources remain for other cognitive tasks.

This cognitive burden manifests in several ways:

- Difficulty concentrating on work tasks or creative projects

- Impaired decision-making abilities across all life domains

- Memory problems, particularly for non-financial information

- Reduced capacity for long-term planning and delayed gratification

- Decreased emotional regulation and increased impulsivity

Ironically, the cognitive impairment caused by financial stress makes effective financial management more difficult. People need maximum mental clarity to navigate complex financial decisions, negotiate with creditors, or develop strategic plans—yet financial stress specifically undermines these capabilities. This represents another cruel cycle where the problem inhibits the solution.

Breaking Point: When Financial Stress Becomes Crisis 🚨

For many people, financial stress exists as a manageable but uncomfortable background condition. However, certain circumstances or accumulations of pressure can transform manageable stress into acute crisis. Understanding these tipping points helps identify when intervention becomes urgent.

Warning Signs of Financial Stress Crisis

Financial stress reaches crisis levels when it produces severe functional impairment or safety concerns. Important warning signs include:

- Complete avoidance of financial matters, including unopened mail or ignored communications

- Substance use increases as coping mechanism for financial anxiety

- Suicidal thoughts or feelings that life isn’t worth living due to money problems

- Severe insomnia or sleep disturbance lasting weeks

- Inability to work or maintain employment due to stress symptoms

- Neglect of children or dependents because of emotional depletion

- Extreme social withdrawal and isolation

These symptoms indicate that professional help has become necessary. Financial stress at this severity constitutes a mental health emergency requiring immediate intervention, regardless of the actual dollar amounts involved.

Finding Light: Paths Toward Emotional Recovery and Financial Stability 💪

While the emotional toll of financial stress is profound, recovery remains possible. Breaking the silence represents the crucial first step. Acknowledging difficulties, seeking support, and implementing strategic changes can gradually reduce both financial pressure and emotional distress.

Practical Steps for Managing Money-Related Emotional Stress

Addressing the emotional dimensions of financial stress requires parallel approaches: managing immediate emotional symptoms while simultaneously working toward practical financial solutions.

Immediate emotional relief strategies:

- Practice deliberate breathing exercises when financial anxiety spikes

- Establish “worry windows”—designated times for addressing financial concerns, containing anxiety to specific periods

- Maintain physical exercise routines to process stress hormones

- Preserve sleep hygiene despite financial worries through consistent routines

- Connect with supportive individuals who can listen without judgment

Longer-term resilience building:

- Seek professional mental health support through therapy or counseling

- Join support groups where others share similar financial struggles

- Develop stress management skills including meditation or mindfulness practices

- Create meaning and purpose beyond financial circumstances

- Build self-compassion, recognizing that financial difficulties don’t define personal worth

Strategic Financial Management to Reduce Stress

While addressing emotional symptoms, parallel financial action reduces the underlying stressor. Even small steps toward financial management can significantly decrease psychological burden by restoring a sense of agency and control.

Effective approaches include:

- Creating comprehensive lists of all debts and obligations to replace vague worry with concrete information

- Prioritizing obligations based on actual consequences rather than emotional pressure

- Communicating proactively with creditors, who often offer more flexibility than expected

- Seeking professional financial counseling or debt management services

- Developing realistic budgets that acknowledge actual income and necessary expenses

- Identifying small, achievable financial goals that build momentum and confidence

Financial management apps can help organize information and track progress, reducing the cognitive burden of manual tracking. These tools transform abstract financial anxiety into concrete, manageable data.

Rebuilding From Financial Trauma: The Long Recovery Journey 🌱

Even after financial circumstances improve, the emotional impact of severe money stress often persists. Financial trauma—the psychological aftermath of extreme financial distress—can continue affecting thoughts, emotions, and behaviors long after crises resolve.

Financial trauma may manifest as:

- Hypervigilance around spending and compulsive checking of account balances

- Difficulty enjoying purchases even when financially appropriate

- Excessive frugality that impairs quality of life despite adequate resources

- Persistent anxiety about potential future financial disasters

- Difficulty trusting financial security even with evidence of stability

Recovery from financial trauma requires patience and often professional support. Recognizing these responses as understandable reactions to genuine threat, rather than personal weakness, facilitates healing. Therapy approaches including cognitive-behavioral therapy and trauma-focused interventions can effectively address financial trauma symptoms.

Creating Compassionate Systems: Why Individual Solutions Aren’t Enough 🤝

While individual coping strategies and financial management skills matter, truly addressing the emotional toll of financial stress requires systemic changes. The widespread nature of financial distress indicates structural problems requiring collective solutions.

Necessary systemic changes include:

- Reducing stigma around financial difficulties through open conversation and education

- Creating accessible mental health services specifically addressing financial stress

- Implementing fairer lending practices and protection from predatory financial products

- Establishing more robust social safety nets preventing crisis-level financial emergencies

- Promoting financial literacy education that includes emotional dimensions of money management

- Developing workplace cultures that acknowledge financial stress and support employee wellbeing

Communities, organizations, and policymakers share responsibility for creating environments where financial struggles don’t translate into emotional devastation. Compassionate systems recognize that financial difficulties represent common human experiences requiring support rather than judgment.

Transforming Shame Into Solidarity: The Power of Shared Stories 📢

Perhaps the most powerful antidote to the emotional toll of financial stress involves breaking silence and building community. When individuals courageously share their experiences with money struggles, they challenge stigma and create connection where isolation previously existed.

Sharing financial difficulties serves multiple purposes. It normalizes struggles that society falsely portrays as rare or shameful. It provides practical information as people exchange resources, strategies, and insights. Most importantly, it generates emotional support and validation, reminding struggling individuals they haven’t failed—they’re experiencing circumstances that millions face.

These conversations needn’t occur publicly or dramatically. Small moments of honesty—admitting to a friend that finances feel tight, acknowledging stress in a support group, or simply refusing to pretend everything’s fine—gradually erode the shame that intensifies financial stress.

Moving Forward: Integrating Financial Wellness With Emotional Health 🌟

Understanding the emotional toll of late payments and money stress transforms how we approach financial difficulties. Rather than treating money problems as purely practical matters requiring only better budgeting or increased income, we can recognize them as holistic challenges affecting every dimension of wellbeing.

This integrated perspective acknowledges that financial wellness requires both practical skills and emotional resilience. It recognizes that mental health treatment might represent the most important “financial” intervention for someone whose depression prevents effective money management. It validates seeking therapy for money stress as legitimate and valuable, not self-indulgent or beside the point.

Most importantly, this perspective replaces judgment with compassion—for others experiencing financial difficulties and for ourselves when we face money struggles. Financial challenges don’t indicate personal failure. They represent complex situations influenced by countless factors, many beyond individual control. Responding with kindness rather than criticism facilitates both emotional healing and practical problem-solving.

The silence around financial stress has caused immeasurable suffering. Breaking that silence—acknowledging the emotional toll, seeking support, and building compassionate communities—creates pathways toward both financial stability and emotional wellbeing. Money problems hurt deeply, but that pain doesn’t need to be carried alone. Through understanding, connection, and systemic change, we can transform how individuals and societies experience and address the profound challenges of financial stress.

Your financial situation doesn’t define your worth, your struggles aren’t signs of failure, and the emotional pain of money stress deserves recognition, validation, and compassionate support. Recovery is possible, help is available, and breaking the silence represents the courageous first step toward healing. 💙

Toni Santos is a behavioral finance researcher and decision psychology specialist focusing on the study of cognitive biases in financial choices, self-employment money management, and the psychological frameworks embedded in personal spending behavior. Through an interdisciplinary and psychology-focused lens, Toni investigates how individuals encode patterns, biases, and decision rules into their financial lives — across freelancers, budgets, and economic choices. His work is grounded in a fascination with money not only as currency, but as carriers of hidden behavior. From budget bias detection methods to choice framing and spending pattern models, Toni uncovers the psychological and behavioral tools through which individuals shape their relationship with financial decisions and uncertainty. With a background in decision psychology and behavioral economics, Toni blends cognitive analysis with pattern research to reveal how biases are used to shape identity, transmit habits, and encode financial behavior. As the creative mind behind qiandex.com, Toni curates decision frameworks, behavioral finance studies, and cognitive interpretations that revive the deep psychological ties between money, mindset, and freelance economics. His work is a tribute to: The hidden dynamics of Behavioral Finance for Freelancers The cognitive traps of Budget Bias Detection and Correction The persuasive power of Choice Framing Psychology The layered behavioral language of Spending Pattern Modeling and Analysis Whether you're a freelance professional, behavioral researcher, or curious explorer of financial psychology, Toni invites you to explore the hidden patterns of money behavior — one bias, one frame, one decision at a time.